Market Risk

The war between Russia and Ukraine has added significant volatility to markets due to:

(1) investors selling down of risk assets,

(2) the impact to higher oil prices that will add to the existing inflationary pressures, and

(3) complications to the central bank outlook on timing and size of the policy tightening cycle.

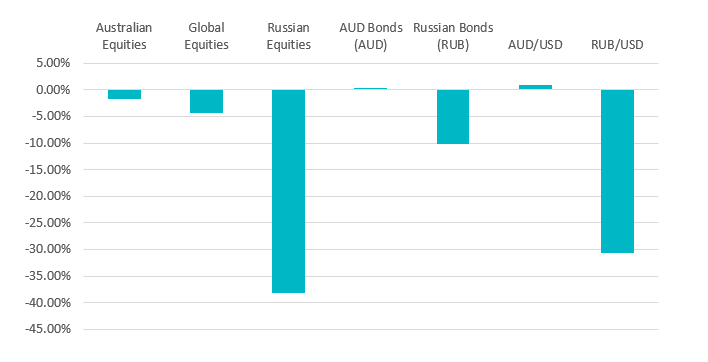

Risk assets such as equities and credit are generally more sensitive to global macro shocks. However, the very large corrections to date have been confined to the Russian financial markets as shown in the chart below.

Chart 1: Market Performance since 16 February 2022

Source: Bloomberg

Portfolio Exposure:

As of 1st March 2022, CCIAM’s exposure to assets with a direct geopolitical link to Russia is limited to three companies within the Global Equities portfolio. This portfolio is managed by Vanguard which is aligned to the FTSE Developed ex Australia Choice Index. CCI has reached out to Vanguard for their response on these holdings. They have stated that they are currently reviewing the various global sanctions to determine the potential impacts to the fund, and where necessary, remove securities that are inconsistent with the company’s global sanctions policy and related procedures.

The table below shows CCIAM’s portfolio exposures by asset class:

Asset Class | Investments | Comments |

Australian Equities | ASX100 index including screened stocks | No direct exposure in Russia and Ukraine |

Global Equities | Vanguard Global Ethically Conscious Fund | The asset class is invested in the world’s largest companies listed in major developed countries. This excludes companies listed on the Russian stock markets. However, there are 3 stocks that generate significant revenue out of Russia. The combined weight of these 3 companies is ~0.03% of the total fund. Further details in the table below. |

Cash | 11am, TDs | No direct exposure in Russia and Ukraine |

Fixed Income | Semi-government bonds, Australian government bonds, Australian Financial credit floating rate notes | No direct exposure in Russia and Ukraine |

Hybrids | Australian Financial hybrid securities | No direct exposure in Russia and Ukraine |

Listed Property | Australian Listed Property index | No direct exposure in Russia and Ukraine |

Unlisted Property | QIC Australian Core Plus Fund | No direct exposure in Russia and Ukraine |

Companies with exposures to Russia:

Company | Activity | Country of Listing | Revenue derived from Russia | Weight of Index |

Coca-Cola HBC | Part of Coca-Cola system with plants throughout Europe, Africa and Asia | UK | 12.60% | 0.013% |

Polymetal International Plc | Provides precious metal mining services with operations in Russia, Kazakhstan and Armenia | UK | 42.40% | 0.003% |

Yandex NV-A | Operates internet website in Russia | US | 100% | 0.013% (currently on trading halt) |

Total weight | 0.029% |

Outlook:

The central outlook is for the war to remain isolated to Russia and Ukraine, but the risk exists for the conflict to extend to other regions. This may roil the broader financial markets and have a significant impact to the CCIAM portfolio.

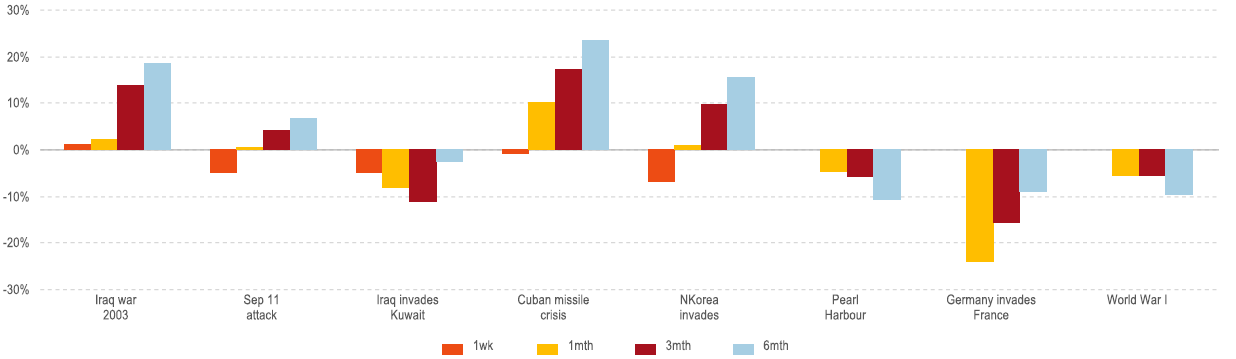

The market's initial knee-jerk reaction to weaken at the onset of a military conflict is typical of past geopolitical events. Historically, political events, with the exception of world wars, have created short-term volatility in markets which was ultimately reversed a few months later. In fact, equity markets after six months had generally recovered and in some cases produced strong positive returns.

Chart 2: Historic Geopolitical Events & Periodic Performance

Source: Frontier